Are you a reluctant renovator?

Before we bought our current property; a 1930s house, we navigated the rite of passage that is being a first time buyer.

Being at the early stages of our careers, Fi and I were on low salaries living in rented accommodation. Quite early in our relationship we started talking about buying a home of our own.

Neil & Fi: THE PRE-PROPERTY “PUPPY FAT” YEARS

I still remember the sharp intake of breath from my parents when I informed them about the price of property in our neck of the woods (we’re down here in the South East). Online calculators helped us to understand what we would be able to borrow and as it turned out, we could just about afford a 1 bed flat though saving for a deposit was going to be tough.

Like every project I start that involves money, I created a big spreadsheet - gotta love ‘em… I documented our incomings and outgoings and worked out where on earth all of our money was going; would you believe it mostly eating and drinking (from the puppy fat above perhaps you guessed!)

We then cut back on our spending big time - we didn’t spend any money on anything apart from the bare essentials. In fact, Fi was since approached by the i newspaper to share her savings tips (although it ruffled a lot of feathers from their Facebook fans). We spent the next couple of years saving and dreaming, managing to amass as much as we possibly could. We even created a vision board and practised the law of attraction (yup we’re secret hippies behind the scenes at Fifi Towers!).

I started to realise that by the time we’d saved enough of a deposit, property prices would have risen to the point that unless something miraculous happened we might not be able to afford anything half decent anymore…

Enter the miracle 🙌

We will be forever grateful to my parents who swooped in and helped with a loan which cut our savings time in half & crucially before the housing ladder was pulled out from under us. We empathise big time with couples who struggle to step onto the housing ladder because if it wasn’t for their help, we think it might not have happened.

We’re conscious that many people aren’t in such a fortunate position and it’s a sorry state of affairs that for many, this sort of intervention is the only way to make it viable. We witnessed first hand through our saving period how tough the process is, essentially sacrificing your overall life enjoyment now so that you fight tooth and nail to get onto the housing ladder later.

In 2013 we moved into our one bed flat!

Fast forward a couple of years, we had made improvements to our flat, paid off a bit of the mortgage on it and thankfully property prices were rising, so we were looking at a bit of equity. To save you from even more rambling, in a nutshell we decided to sell our flat and upsize to another property.

The images below were the ones we used to sell the flat.

The next property - the reno

It really boiled down to two options:

Option 1 - Buy a house that was already renovated for about £400K

Option 2 - Buy a house that needed renovating for around £330K and use the £70K equity to renovate

We had nowhere to turn to understand how renovations worked. So not really knowing what kinds of stress levels, time commitment, hidden costs and unknown challenges a renovation property posed, it was an extremely tough and heavily considered decision.

Viewing fixer upper properties made us even less enthusiastic. Forever seared into our memories and nostrils will be the urine-encrusted WC from hell in a 3 bed house we looked at in central Brighton (not the one we went with!).

But the alternative (Option 1) wasn’t much better. Many properties that have been bought to renovate and sell, or ‘flipped’, compromise on the style; creating a cookie cutter look that may have been difficult for us to really feel at home in. Plus you pay for someone else’s style. Changing it would mean spending money that we didn’t have revising a brand new, but generic interior that didn’t exactly fit our needs.

So we chose to buy a renovation property and the rest is history, our 1930s house renovation is documented in detail on our blog.

THE CARPET OF DEATH

THE DAY WE MOVED IN - PUPPY FAT STILL KNOCKING ABOUT

The reluctant renovators

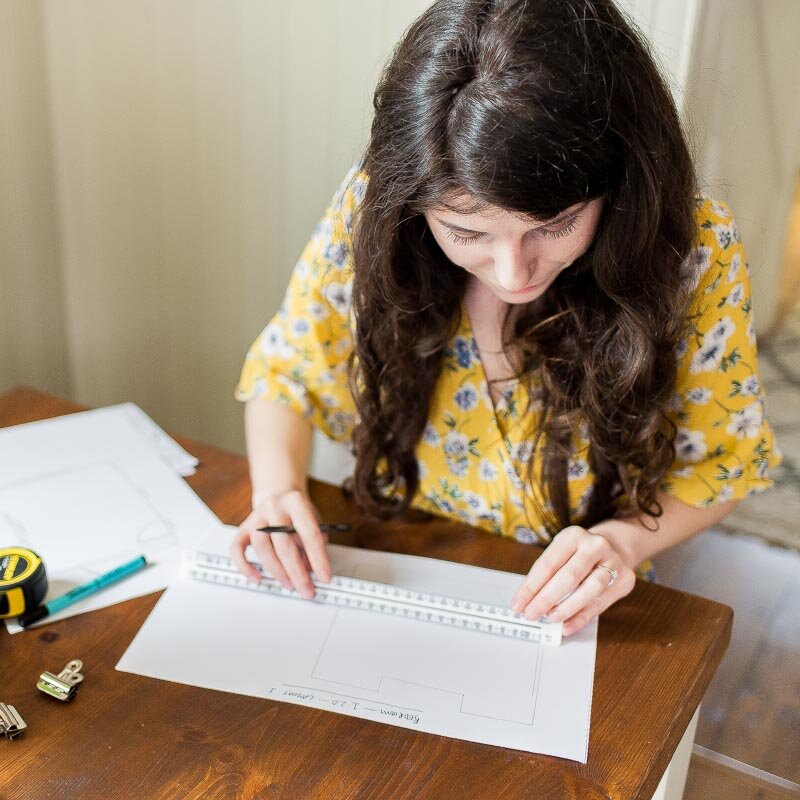

Years later we look back on our journey, from humble beginnings as a couple with a hobby interiors & lifestyle blog, through to renovating a house and then creating an interior design business assisting renovators through our services, content, courses & community.

It’s been an exciting journey that has built us in ways and changed our life in ways we never imagined, but we’d be lying if we said we had our journey entirely planned…

The other day Fi and I were discussing how for us, getting into a renovation was never the fulfilment of a long-standing aspiration, it was initially because the alternative just wasn’t palatable.

Many people don’t get into renovations because they are up for an exciting thrill ride to get the house of their dreams. Many start by wanting the best for their lives and their loved ones and through pure necessity, they reluctantly warm themselves up to the idea of becoming a renovator.

As a potential renovator you start out by contemplating a huge project with “unknown unknowns” and other elements that you are unprepared for.

And that’s why we created our online renovation course and community the Reno Club. Because a well-trodden path is the easier path to follow.

Life changing

If you take the next step and choose to renovate, what happens next can be almost magical;

You turn your fears into challenges

You see solutions where there are problems

You take the bull by the horns in a way that might surprise you

We see a transition that our students go through, hearing about their initial fears and lack of knowledge, and then once they start using the course framework and community, enjoying a rewarding & exciting process that doesn’t have to be as complicated and stressful as they first thought.

Renovating could be one of the most challenging projects you will ever do, but seeing the fruits of your labour coming together over time; creating a beautiful, secure, and entirely customised home surely make it the most rewarding.

Hope to see you on our next course enrolment!